Bad Fiscal Management may be behind Development Rush.

To Bill Hayes and other citizens of GT:

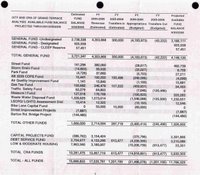

Bill's question is about the "income" for the entire City and the Day Care and the Redevelopment Agency. I believe the newspaper misquoted Tom on the $24 million number. Our Total Expenses will be about $21.5 million. Bill Hayes is asking about the INCOME which is $17.5 million. Tom Schwab has provided with the following. The City accountants call it "Revenues", you and I would call it "Income." Go to the one page recap of the city/ CRA Budget. The first column is the money in the bank as of June 30,2005 last year; at the start of the fiscal year.

The second column is the one Bill wants clarified. The first amount is $4,353.968 which is revenue to the City to pay for the day to day expenses or appropriations which are shown in the fourth column. These are City imposed fees and taxes. They make up of this $4.3 mil is as follows:

Re: General Fund Revenues $4.3 million

property tax .......................................................457,108.00

license and permits........................................ 770,653.00

sales & use taxes .............................................1,379,380.00

county solid waste ................................................64,420.00

engineering, planning and park fees ................148,877.00

child care .............................................................902,941.00

fines, citations, & cities ........................................26,526.00

investment, rent, property sale ......................534,040.00

refunds, rebates & misc. ............ ........................55,200.00

workers comp refund ......... ....... .........................14,823.00

total ..............................................................$4,353,968.00

The next thirteen line items are various funds that have Federal, State or Local taxes coming to us but for specific uses that we must verify and honor. For example the AB 3229 COPS is State money that must be used on Police protection that is not a part of the normal program of Police protection. The Waste Water Disposal must be used to pay for our Colton sewer service and sewer pipe repair. The Measure I Funds must be used on traffic and issues and approved by SANDBAG. You get the idea, the money comes in for a specific issue and it goes out for that specific issue. (And they remain UNEXPLAINED)

So the total for these thirteen funds is $2,714,094.

The next three line items are involved with the Community Redevelopment Agency (CRA).

CAPITAL PROJECTS FUND $3,154,424

This includes interest income from

the $12,000,000 we have in savings $ 30,000

Sale of land to the School District

(which is still in escrow) $3,124,424

TOTAL = $3,154,424

DEBT SERVICE FUND (Redevelopment tax income) $4,133,288

LOW & MODERATE HOUSING ( more Redevelopment tax

Income, but this is called the 20% set aside and must be

spent on low and moderate housing or senior housing and

we have chosen to spend it on senior housing. We must

spend this money in five years or the State can take it away.) (Actually this is what was miss appropriated for the purchase of City Assets see State Auditor's Report. In addition The Use of LMH Funds can not be limited to Seniors Only)

The next thirteen line items are various funds that have Federal, State or Local taxes coming to us but for specific uses that we must verify and honor. For example the AB 3229 COPS is State money that must be used on Police protection that is not a part of the normal program of Police protection. The Waste Water Disposal must be used to pay for our Colton sewer service and sewer pipe repair. The Measure I Funds must be used on traffic and issues and approved by SANDBAG. You get the idea, the money comes in for a specific issue and it goes out for that specific issue. (And they remain UNEXPLAINED)

So the total for these thirteen funds is $2,714,094.

The next three line items are involved with the Community Redevelopment Agency (CRA).

CAPITAL PROJECTS FUND $3,154,424

This includes interest income from

the $12,000,000 we have in savings $ 30,000

Sale of land to the School District

(which is still in escrow) $3,124,424

TOTAL = $3,154,424

DEBT SERVICE FUND (Redevelopment tax income) $4,133,288

LOW & MODERATE HOUSING ( more Redevelopment tax

Income, but this is called the 20% set aside and must be

spent on low and moderate housing or senior housing and

we have chosen to spend it on senior housing. We must

spend this money in five years or the State can take it away.) (Actually this is what was miss appropriated for the purchase of City Assets see State Auditor's Report. In addition The Use of LMH Funds can not be limited to Seniors Only)

$3,180,007

TOTAL FOR THE CRA 10,467,719

TOTAL FOR THE CITY, DAY CARE AND CRA $17,535,781

This is the estimate at the bottom of the Revenues Column ! !

We plan to take about $7,963,560 out of the LOW & MODERATE HOUSING FUND to pay for the Senior Housing. The result is a $21,498,278 total Appropriations (or expenses) for the year. I think the $24 million reported in the newspaper is a misunderstanding. Our TOTAL appropriations (or expenses) are $21.5 million. Our total planned revenue (or income) is $17,535,781.

Now Bill, I do hope we have started to answer you original question. I am truly sorry it took so long. The underlying questions are 1) Do we take any money from Jacobsen to run the City? No, he donates $7,500 to GT Days and he is paying normal fees to build the Sav-on Store. No money goes to the City to help run the City. 2) Did we borrow any extra cash to help pay for the day to day operations when we refinanced the CRA Debt a couple of years ago? No, our debt now and in the past is solely for the Fire Station, City Hall, Day Care, Pico Park and now to build the Senior Housing. We never borrow funds to pay for day to day operation of the City.

Thanks for listening,

TOTAL FOR THE CITY, DAY CARE AND CRA $17,535,781

This is the estimate at the bottom of the Revenues Column ! !

We plan to take about $7,963,560 out of the LOW & MODERATE HOUSING FUND to pay for the Senior Housing. The result is a $21,498,278 total Appropriations (or expenses) for the year. I think the $24 million reported in the newspaper is a misunderstanding. Our TOTAL appropriations (or expenses) are $21.5 million. Our total planned revenue (or income) is $17,535,781.

Now Bill, I do hope we have started to answer you original question. I am truly sorry it took so long. The underlying questions are 1) Do we take any money from Jacobsen to run the City? No, he donates $7,500 to GT Days and he is paying normal fees to build the Sav-on Store. No money goes to the City to help run the City. 2) Did we borrow any extra cash to help pay for the day to day operations when we refinanced the CRA Debt a couple of years ago? No, our debt now and in the past is solely for the Fire Station, City Hall, Day Care, Pico Park and now to build the Senior Housing. We never borrow funds to pay for day to day operation of the City.

Thanks for listening,

Herman Hilkey Councilman

Bill's reply to Hilkey:

Councilman Hilkey, Thank you for your effort. I did not ask if Jacobsens money runs the City, I have no idea where that came from. Although to an great extent it speaks louder than the voices of the voters of this community, especially at City Hall. I asked if RDA/CRA funds were used for the everyday operations of the City. Your beginning to sound like Mr. Schwab, answering questions I didn't ask. Bill Hays

Gramps Review of the Above Data is in read above and below:

Mr. Hilkey's Answer is only a partical illumination as to the Source of Revenue or Income. He still has Failed to identify where the Money Comes from for the CRA... is it DEBT... Are we Working our budget with funds simular to Equity Funds on a House Credit Equity Loan? A DEBT.. That is the answer of the WHOLE Questioun.

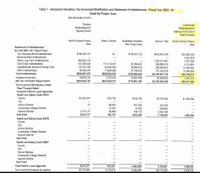

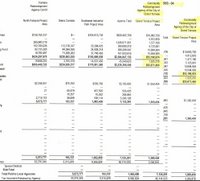

Steve WestlyCalifornia State Controller Writes:Community Redevelopment Agency of the City of Grand Terrace:

The compliance audit opinion noted the following areas of noncompliance:A. The agency did not file the property report or blight progress report for the fiscal year ended June 30, 2003, as required by Code Section 33080.1;B. The agency’s implementation plan does not provide any documentation or inventory of the reported affordable units or evidence that the units meet statutory requirements for production units, as required by Code Section 33490(a); andC. The agency’s implementation plan does not meet the requirements of Code Section 33413(b) (4); it does not identify the number of units rehabilitated in the project within the 10-year period.

__________________________________

In the same report the fallowing information if included about the Redevelopment Agency of Grand Terrace.

15% vacant land left of 2368 acres = the whole town14.56 million tax increment what?1.9 million construction of what1.6 million "other" expenses on What?total equity $14.45 million of what?1993 $6,735,000. in city "capital improvement" expendituresTotal Required Funds? Debt? $52,196,674 for 2003-2004

The compliance audit opinion noted the following areas of noncompliance:A. The agency did not file the property report or blight progress report for the fiscal year ended June 30, 2003, as required by Code Section 33080.1;B. The agency’s implementation plan does not provide any documentation or inventory of the reported affordable units or evidence that the units meet statutory requirements for production units, as required by Code Section 33490(a); andC. The agency’s implementation plan does not meet the requirements of Code Section 33413(b) (4); it does not identify the number of units rehabilitated in the project within the 10-year period.

__________________________________

In the same report the fallowing information if included about the Redevelopment Agency of Grand Terrace.

15% vacant land left of 2368 acres = the whole town14.56 million tax increment what?1.9 million construction of what1.6 million "other" expenses on What?total equity $14.45 million of what?1993 $6,735,000. in city "capital improvement" expendituresTotal Required Funds? Debt? $52,196,674 for 2003-2004

The entire report is available for the asking... Just drop us an email.

posted by GrandPaTerrace at Sunday, January 22, 2006

posted by GrandPaTerrace at Sunday, January 22, 2006